By: Liam R. F. Bird

This report isn’t just data—it’s a mirror. It reflects what most public institutions, investors, and consumers already feel but don’t yet have the language or metrics to prove: that equity in corporate America is largely symbolic, selectively applied, and structurally absent.

The 2025 Consumer Equity Index (CEI) is a structural assessment tool grounded in community co-design, racial capitalism critique, and targeted universalism. It evaluates the top 100 Fortune-ranked corporations by examining how their operations align with or undermine justice across labor, environmental, racial, political, and economic domains. These companies move trillions in capital and reach into nearly every U.S. household—impacting wages, public health, surveillance, ecological degradation, and civil rights outcomes at scale.

This isn’t an ESG score. It’s not a performative checklist. It’s a field-tested tool for measuring structural equity in a time when equity itself is under political attack. And the findings are clear: while a few firms are moving toward community-centered governance, most are maintaining extractive systems. Some are actively reinforcing repression.

This index empowers organizers, local governments, procurement officers, and values-driven consumers with a new way to engage power. We cannot afford to spend blindly. Not when 70% of our everyday dollar flows through companies graded C, D, or F on this index (and 90 percent are).

Introduction

At LRFB Equity Consulting, we define equity as a political stance rooted in historical struggle, power redistribution, and structural accountability. We’ve seen how institutions—whether schools, cities, or corporations—use equity language while preserving decision-making hierarchies and white supremacist norms. In 2025, amid anti-DEI legislation, rollback of affirmative action, and repression of Palestine solidarity organizing, the question is not whether companies mention equity—it’s whether they structure it.

The CEI is a tool to expose that structure. Using the same lens we bring to public sector equity audits and community co-design initiatives, we examined how the Fortune 100 show up—or don’t—for equity. This index centers those furthest from opportunity and measures how well companies are designing for, accountable to, and governed by the people and communities most impacted by their operations.

This is not a consumer tool designed to shame individual purchasing choices. It’s a systemic mapping of harm and power—a tool for redirection, transparency, and strategic resistance.

Methodology

We evaluated each Fortune 100 company across seven equity indicators, weighted according to structural impact and alignment with our co-design principles:

| Indicator | Definition | Weight |

| Labor Rights & Practices | Fair wages, union protections, child labor, warehouse safety, contractor treatment | 20% |

| Environmental Justice | Fenceline pollution, Indigenous land harm, extractive operations | 15% |

| Racial Capitalism & Structural Extraction | Profit derived from racialized disinvestment, surveillance, or policy manipulation | 15% |

| Transparency & Accountability | Public reporting of DEI metrics, pay equity, and supply chain labor conditions | 10% |

| Human Rights Commitments | Policy positions, contracts, and harms tied to Palestine, immigration, and criminalization | 15% |

| Political Influence & Lobbying | Alignment of political spending with equity, democracy, and worker protections | 15% |

| Sustainability & Long-Term Equity | Real (not greenwashed) investment in circular economies, divestment, and regeneration | 10% |

Letter Grade Scale (based on a 100-point rubric):

- A (60–70) – Structural equity embedded in governance and operations

- B (50–59) – Promising equity infrastructure with key limitations

- C (35–49) – Inconsistent, surface-level, or PR-driven equity work

- D (20–34) – Documented harm, exclusion, or unaccountable practices

- F (Below 20) – Active repression, systemic extraction, or policy harm

Findings: Most of Our Economy Still Funds Inequity

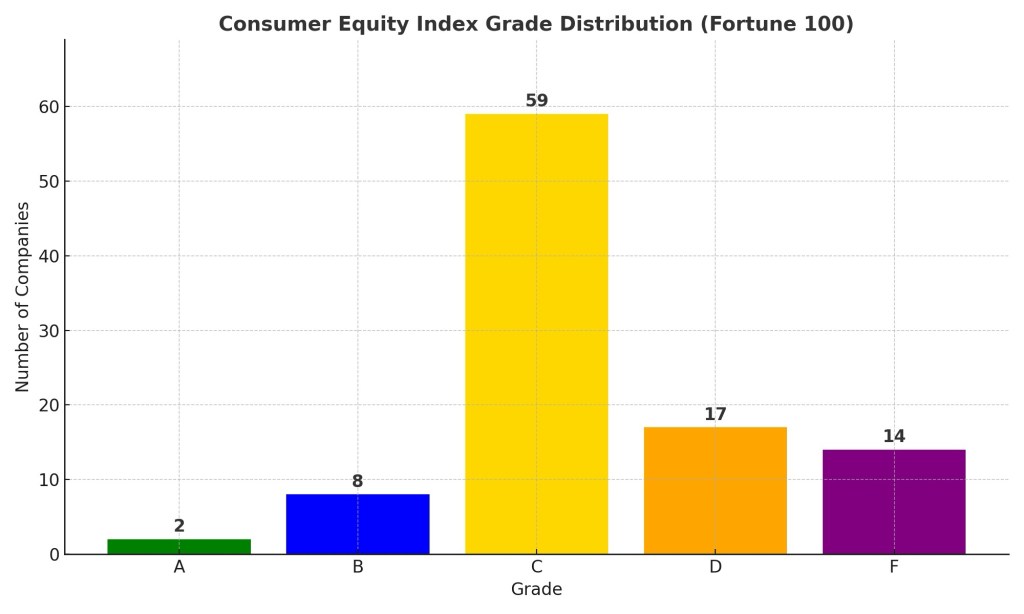

The vast majority of America’s largest companies remain inconsistent—or outright harmful—on equity. Only 2 companies achieved an A grade for structurally embedding equity into their governance and operations. 8 companies earned a B grade, reflecting promising practices but key limitations. The largest share—59 companies—received a C grade, showing surface-level commitments or inconsistent application of equity principles. 17 companies earned a D grade for documented harm, exclusion, or a lack of public accountability. And 14 companies received an F grade, representing firms that actively engage in extractive and repressive practices with no equity alignment.

- 2 companies earned an A

- 8 companies earned a B

- 59 companies earned a C

- 17 companies earned a D

- 14 companies earned an F

Let’s be clear: 90% of these firms are not equity-aligned. That means nearly all public contracts, retirement accounts, digital platforms, and everyday services move through companies that perpetuate systemic harm—especially for Black, Indigenous, low-income, immigrant, disabled, and trans communities. Our dollars reinforce injustice, unless we redirect them. The CEI distribution underscores the urgent need to rethink how we engage with corporate power.

A Grade Companies (Excellent Equity Performance)

These companies demonstrate equity leadership across index dimensions:

- Microsoft (#14) – Leads the tech sector in transparency, workplace equity, and climate action with consistent follow-through.

- Best Buy (#66) – Champions tech access for BIPOC youth and supplier equity, earning top marks for both internal and external impact.

B Grade Companies (Above Average Equity Performance)

These companies outperform peers on multiple equity fronts but have gaps preventing an A:

- Costco Wholesale (#11) – Offers high wages, union engagement, and sustainable sourcing in a retail environment often marked by exploitation.

- Merck & Co. (#69) – Develops life-saving medicines and commits to inclusive clinical trials, though pricing and patent practices still warrant scrutiny.

- Allstate (#84) – Prioritizes inclusive hiring, community giving, and sustainability transparency beyond industry norms.

- IBM (#82) – A legacy firm with strong public-facing DEI and pay equity data, though it lags in product-level justice efforts.

- Progressive Corporation (#85) – Pioneers LGBTQ+ inclusion in advertising and customer service while maintaining internal accountability.

- Cisco Systems (#74) – Integrates racial equity into supplier contracts and education grants, showing strong cross-sector responsibility.

- Prudential Financial (#65) – Engages in racial wealth gap mitigation and shows consistent philanthropic equity investments.

- American Express (#78) – Supports BIPOC entrepreneurs and internal DEI while also maintaining strong public accountability.

C Grade Companies (Average Equity Performance)

Over 50 companies fall in this range—adequate in some areas, but inconsistent overall:

- Apple (#4) – Champions user privacy and climate neutrality but scores lower on labor practices and has resisted unionization efforts.

- UnitedHealth Group (#5) – Expands health access but employs biased algorithms and has faced inequities in mental health coverage.

- CVS Health (#6) – Invests in diverse hiring and health equity programs but maintains opaque practices in pharmacy benefit management.

- Alphabet (Google) (#8) – Claims AI ethics leadership and climate action, yet punishes employee activism and struggles with platform fairness.

- JPMorgan Chase (#23) – Makes multibillion-dollar racial equity pledges, though legacy discriminatory lending still impacts trust.

- Cigna Group (#15) – Supports Medicaid expansion and mental health initiatives, but equity metrics remain buried in legal and financial red tape.

- Ford Motor Company (#19) – Invests in clean energy vehicles and union jobs but falls short on enforcing internal DEI commitments.

- Bank of America (#24) – Funds equity nonprofits but continues to face criticism around predatory fees and widening wealth gaps.

- General Motors (#21) – Touts diversity hiring and EV innovation, though past race-related lawsuits lower its equity index.

- Elevance Health (Anthem) (#22) – Made moves in maternal health equity but was fined for Medicaid access gaps.

- Citigroup (#36) – Offers major public pledges on racial equity while still holding onto predatory lending histories.

- Centene (#25) – A Medicaid giant with strong health access efforts but under fire for upcoding and overbilling practices.

- Home Depot (#17) – Strong on sustainable materials and some DEI training, but still weak on pay equity and supplier justice.

- Fannie Mae (#28) – Supports low-income lending and tracks racial homeownership gaps, yet contributes to gentrification through lending practices.

- Meta Platforms (Facebook) (#31) – Supports equity externally in content creation but suppresses internal calls for justice.

- Verizon Communications (#26) – Funds racial justice initiatives but hasn’t addressed algorithmic harms or media consolidation.

- AT&T (#13) – Offers broadband equity programs yet fails to exhibit consistent racial equity leadership in its products.

- Comcast (#29) – Commits to digital equity and BIPOC grants but draws criticism for high costs and wage gaps in its workforce.

- Goldman Sachs (#55) – Funds Black women’s wealth initiatives and equity ventures while continuing speculative practices that fuel inequality.

- Freddie Mac (#45) – Makes strides in home ownership equity transparency but remains tied to subprime and foreclosure patterns.

- Target (#33) – Earns praise for supplier diversity and representation, though labor complaints persist in its frontline workforce.

- Humana (#42) – Known for senior health programs, yet rates poorly on mental health access and internal transparency.

- Morgan Stanley (#63) – Celebrated for philanthropy and diversity reports but accused of gender and pay discrimination within its ranks.

- Johnson & Johnson (#40) – Publicly pro-equity in messaging but still pays for harmful products and uses legal maneuvers to avoid accountability.

- PepsiCo (#46) – Commits to local sustainability but faces criticism for sugary products and exploitative water sourcing.

- UPS (#37) – Secures strong union contracts and Black executive leadership but is docked for emissions and warehouse safety issues.

- FedEx (#41) – Invests in community aid and DEI language but fails to promote Black executives and meet climate goals.

- Walt Disney (#48) – Embraces LGBTQ+ inclusion in content, though pay equity and contractor diversity remain concerns.

- Dell Technologies (#58) – Publishes workforce equity data and funds STEM initiatives but avoids major corporate advocacy on social issues.

- Procter & Gamble (#51) – Leads in inclusive marketing but generates plastic waste and has been slow to remedy environmental harms.

- Albertsons (#53) – Champions hunger relief, but its merger plans with Kroger raise food desert and labor equity fears.

- Sysco (#57) – Collaborates with small suppliers but maintains underreported union conflicts and warehouse inequities.

- General Electric (#54) – Transitions toward renewable energy while dragging legacy pollution and racial gaps in upper leadership.

- MetLife (#55) – Supports diverse talent pipelines but evades transparency in equitable life insurance practices.

- Deere & Co. (John Deere) (#83) – Promotes worker safety and community farming programs but fights right-to-repair legislation that would empower low-income customers.

- StoneX Group (#61) – Maintains a low-controversy profile but scores poorly on transparency, DEI leadership, and industry equity engagement.

- Pfizer (#38) – Delivered global vaccines yet profits from inaccessible drug pricing and intellectual property barriers.

- Delta Air Lines (#87) – Markets inclusion but undercuts workers and avoided bold climate justice policy commitments.

- TD Synnex (#66) – Offers neutral IT logistics services with limited proactive equity or justice disclosures.

- Publix Super Markets (#80) – Locally rooted grocer with charitable giving, but weak DEI data and regressive stances on public health mandates.

- Nationwide Insurance (#85) – Gives generously and hires diversely but shares no public DEI audits or substantive equity reforms.

- New York Life Insurance (#73) – Boasts family-first policies and community service, yet remains silent on racial equity standards and transparency.

- Intel (#64) – Makes progress on tech workforce diversity but has seen major layoffs and hesitates on global labor protections.

- TJX Companies (TJ Maxx) (#89) – Values discount retail inclusion through diverse vendors but avoids meaningful labor equity upgrades.

- HP (Hewlett-Packard) (#65) – Commits to climate action and pay equity, though it outsources labor to jurisdictions with weak standards.

- Performance Food Group (#93) – Distributes food with mild DEI efforts and no major controversies, reflecting only average engagement on equity issues.

- Liberty Mutual Insurance (#88) – Funds education and access initiatives, yet has been sued for gender pay gaps and biased pricing practices.

- Nike (#95) – Markets social justice and supports athletes of color but still sources from factories with exploited labor.

- CHS Inc. (#92) – Farmer-owned cooperative with rural community investments, but fails to address refinery safety and emissions impacts.

- Bristol-Myers Squibb (#97) – Innovates in inclusive clinical trials while following big pharma playbooks on high pricing and patent control.

- American International Group (#78) – Provides diverse leadership and disaster relief giving but avoids deeper long-term equity commitments.

- State Farm (#44) – Leans on community branding and inclusive marketing, but as a mutual insurer it discloses little about internal diversity or equitable claim practices.

- Lowe’s (#39) – Highlights veteran hiring and community grants, yet its non-union stance and wage practices trail industry equity standards.

- Wells Fargo (#47) – Publicly touts diversity and inclusion programs but has repeatedly been fined for discriminatory lending and fraudulent accounts.

- Walgreens Boots Alliance (#27) – Implements health equity initiatives and supplier diversity goals, but opioid lawsuit liabilities and retail pay gaps tarnish its record.

- Charter Communications (#81) – Expands broadband access in underserved areas, yet mirrors peers in low executive diversity and disputes over fair labor practices.

- American Airlines (#91) – Champions multicultural marketing and Employee Resource Groups, while ongoing labor conflicts and customer service gaps show below-average equity follow-through.

- United Airlines (#98) – Invests in diverse hiring (pilots and leadership) and some sustainability efforts, yet still grapples with notable racial bias incidents and labor tensions.

- Qualcomm (#100) – Innovates in wireless tech and supports STEM education for underrepresented groups, but provides limited transparency on supply chain labor and internal pay equity.

D Grade Companies (Below-Average Equity Performance)

These companies have significant equity gaps across operations, including labor violations, environmental harm, weak DEI infrastructure, or exploitative pricing:

- Berkshire Hathaway (#7) – Global conglomerate that has done little to advance corporate transparency or diversity, maintaining a famously insular leadership and weak accountability on equity.

- McKesson (#9) – Distributes pharmaceuticals nationwide but has faced minimal accountability for its role in the opioid crisis and shows scant commitment to DEI in its ranks.

- Censora (formerly AmerisourceBergen) (#11) – Pharma distributor tied to opioid settlement fines and focused on profit, with equity and transparency largely absent from its governance.

- Cardinal Health (#14) – Healthcare supplier that makes surface-level diversity pledges while bearing legal burdens for past opioid missteps and lacking community accountability.

- Kroger (#24) – Dominant grocery chain investing in workforce diversity programs, yet notorious for low wages, union resistance, and a pending merger raising serious labor equity fears.

- ADM (Archer Daniels Midland) (#35) – Processes global food commodities but fails to track equity in its supply chain and has been linked to labor exploitation in agriculture.

- Bunge (#58) – Agribusiness giant that continues deforestation and land-use inequities with only minimal investment in reparative community partnerships .

- Lockheed Martin (#62) – Defense contractor with some internal diversity efforts, yet its core business of profiting from militarism and surveillance undercuts any claimed equity stance.

- Caterpillar (#70) – Fuels extractive mining and militarized policing globally, with limited environmental or labor repair efforts in impacted communities.

- Boeing (#60) – Promotes diversity hiring but evades accountability for fatal safety lapses and relies on subcontractors with poor labor practices.

- Raytheon Technologies (#59) – Weaponizes equity language while profiting from militarism, border violence, and surveillance tech.

- Johnson Controls (#97) – Sells surveillance tech to ICE and prisons while hiding workforce and emissions data behind privacy shields.

- Thermo Fisher Scientific (#99) – Sets equity goals in education, but profits from DNA technology sold to authoritarian regimes, reflecting poor ethical accountability .

- AbbVie (#75) – Uses lobbying to block drug price reform while outsourcing production to countries with poor labor standards.

- Abbott Laboratories (#89) – Pays fines for baby formula contamination and has lobbied against equitable nutrition policies, highlighting a pattern of profit over people.

- Tesla (#50) – Pushes the envelope in clean technology, yet has a documented history of union busting, racial discrimination lawsuits, and an ego-driven culture that undermines worker well-being.

- PBF Energy (#94) – Operates oil refineries with a record of pollution in fenceline communities and scant disclosure of environmental justice impacts.

F Grade Companies (Systemic Equity Failure)

These companies consistently exhibit extractive practices, systemic abuse, and direct harm to historically excluded communities. Their records suggest a refusal to engage in meaningful equity transformation:

- Amazon (#2) – Suppresses labor organizing, deploys intrusive algorithmic surveillance, and profits from dangerous warehouse conditions.

- Walmart (#1) – America’s largest employer that built its model on low wages and aggressive union busting, using philanthropy and PR to mask systemic labor exploitation.

- Exxon Mobil (#3) – Doubly failing on both climate justice and racial equity – a top polluter with a legacy of environmental racism and denial of community reparations.

- Chevron (#10) – Repeatedly sued Indigenous leaders and climate activists while worsening global ecological harm and funding anti-climate lobbying.

- ConocoPhillips (#49) – Expands fossil fuel infrastructure despite community opposition, ignoring equity protests and court challenges.

- Marathon Petroleum (#16) – Dumps toxic pollution in Black communities and steadfastly refuses community-led environmental negotiations.

- Tyson Foods (#82) – Fails every metric on labor safety (even using child labor), undermines undocumented workers’ rights, and has one of the worst DEI records in food manufacturing.

- Dow Inc. (#77) – Continues a legacy of environmental violence and toxic exposure, with forced sterilization chemicals and aggressive anti-transparency tactics.

- Phillips 66 (#17) – Builds wealth on fossil fuel extraction while providing no measurable justice outcomes or community restitution.

- Valero Energy (#18) – Ignores pleas from fenceline Black neighborhoods while expanding polluting refineries, showing a blatant disregard for public health.

- Energy Transfer (#43) – Symbolizes fossil-fueled violence – deploying private security against land protectors and displacing Native communities with pipeline projects.

- Enterprise Products Partners (#74) – Avoids public disclosure while funneling billions into non-renewable pipelines, offering zero human rights or equity accountability.

- Plains GP Holdings (#76) – Fails to remediate long-standing oil spills and maintains one of the lowest transparency scores in the industry.

- World Kinect (World Fuel Services) (#72) – A silent energy profiteer with no environmental justice goals and zero DEI reporting or engagement.

Recommendations: What We Do With This Power

- Build the CEI into a Public Equity Intelligence Tool

We need a browser plug-in and mobile app that lets people scan a company and see its equity score—similar to nutrition labels or sustainability certifications. Let’s democratize access to justice data.

- Create a CEI Certification and Procurement Standard

Institutions should only contract with firms that meet CEI thresholds. Like LEED or Fair Trade, we can certify companies that practice structural equity—and blocklist those that do harm.

- Expand Beyond the Fortune 100

Let’s evaluate city vendors, school suppliers, tech platforms, universities, and healthcare monopolies using this same framework. Structural equity is not sector-bound.

- Support Co-Design in Corporate Accountability Campaigns

Workers, communities, and policy leaders should be able to co-design equity solutions with firms—and hold them accountable when they don’t. CEI data should drive those campaigns.

Conclusion: The Power of Knowledge Access

To borrow from our Community Co-Design for Equity Framework, equity is not about inviting people in. It’s about transforming who holds power, how decisions get made, and which lives are centered in our systems.The Consumer Equity Index names what is often obscured: that most corporate equity language is non-binding, unmeasured, and untethered from those most impacted by inequity. In a racial capitalist economy, our dollars are votes. Our silence is policy. And our visibility is leverage. This is a tool to see what you’re funding—and what you can shift.

Let’s stop spending on extraction. Let’s start investing in liberation.

Bibliography

- U.S. Securities and Exchange Commission (SEC). Public 10-K and Proxy Filings. https://www.sec.gov/edgar

- Equal Employment Opportunity Commission (EEOC). “Diversity and Inclusion Workforce Data.” https://www.eeoc.gov

- Environmental Protection Agency (EPA). “Enforcement and Compliance History Online (ECHO).” https://echo.epa.gov/

- Greenpeace. Corporate Plastic Polluters Rankings, 2023. https://www.greenpeace.org/

- Human Rights Campaign. Corporate Equality Index, 2022–2024. https://www.hrc.org/

- U.S. Department of Labor. “Wage and Hour Compliance Actions.” https://www.dol.gov/agencies/whd/data

- OpenSecrets.org. “Corporate Political Contributions Database.” Center for Responsive Politics. https://www.opensecrets.org

- Global Reporting Initiative (GRI). “Sustainability Reporting Standards.” https://www.globalreporting.org

- CDP (Carbon Disclosure Project). Climate Disclosure Reports, 2020–2024. https://www.cdp.net

- Amnesty International. Corporate Human Rights Benchmark, 2023.

- Business & Human Rights Resource Centre. Company Response Tracker. https://www.business-humanrights.org

- National Employment Law Project. Labor Violations in Low-Wage Industries, 2021–2024.

- The New York Times, Business Section, 2020–2025.

- The Guardian. Investigative Series on Climate and Capitalism, 2022–2024.

- ProPublica. Workplace Inequity and Environmental Justice Investigations, 2021–2025.

- Food & Water Watch. Corporate Accountability Reports, 2023–2024.

- Institute for Policy Studies. Executive Pay and Inequality Reports, 2022–2024.

- UC Berkeley Labor Center. Low-Wage Work in Corporate America, 2021–2024.

- Just Capital. Corporate Rankings on Worker and Community Investment, 2023–2024.

- American Civil Liberties Union (ACLU). Corporate Speech and Censorship Reports, 2022–2024.

- Harvard Business Review. “Corporate ESG and Equity Performance,” selected articles, 2021–2024.

Legal Disclaimer:

The Consumer Equity Index is a research-based assessment produced by LRFB Equity Consulting, LLC. All evaluations, scores, and letter grades reflect the application of a proprietary framework grounded in publicly available data and our firm’s equity indicators. This report includes both factual summaries and opinion-based analysis. The conclusions drawn represent the professional judgments of the authors based on disclosed methodology and criteria.

Nothing in this publication should be interpreted as a statement of fact regarding any company’s intent, legality of conduct, or internal operations. LRFB Equity Consulting, LLC makes no warranties regarding the completeness or accuracy of third-party data sources. Companies are encouraged to provide clarifying information, which may be reflected in future iterations.

Leave a comment